The electrical and political earthquake triggered by Monday's blackout has reached New York. The US fund BlackRock, the world's largest asset manager, has reduced its exposure to Redeia, the parent company of Red Eléctrica, after the blackout. This Friday, the first trading day since Wednesday, the company leads the declines in the Ibex 35.

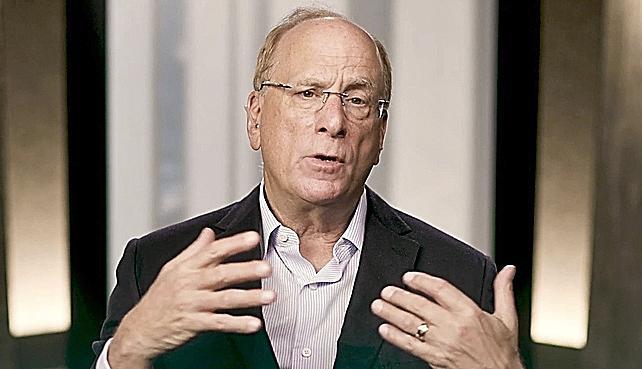

Until Wednesday, April 30, the third day of the energy blackout, the fund led by Larry Fink was the largest private shareholder of Redeia, with a 5.02% stake. That day, the fund reduced its exposure to 4.992% by selling derivatives, as reflected in the records of the National Securities Market Commission (CNMV) and reported by Expansión today. Although it is a small reduction, it is significant due to the political moment in which it occurs and because it represents a change in the shareholder hierarchy of the group.

The second reason why BlackRock's move is relevant is that by dropping below 5%, it establishes a new shareholder structure. Pontegadea, the investment arm of tycoon Amancio Ortega, rises and becomes the largest private shareholder of the company, with the 5% stake it has held since 2021. Sepi, the investment holding company under the Ministry of Finance, is its largest shareholder, with 20%.

Redeia, which manages critical infrastructure such as the national power grid and its operation, stipulates in its bylaws that no private shareholder can have a direct or indirect stake exceeding 5% of the share capital, nor exercise political rights above 3%. This condition leaves the State as the main shareholder ad aeternum of the group presided over by Corredor.

This Friday, the company leads the declines in the Ibex 35 at the opening, with a 4.1% decrease in its value. It continues with the downward trend of recent days following Monday's blackout: on the last trading day in the Spanish stock market (April 30), Redeia closed with a 3.65% loss in value, ranking as the second most affected stock. On Tuesday, the day after the blackout, it closed the session in the red, with a 0.415% decrease. Analysts indeed highlight the investors' exodus from the company, which remains under scrutiny following Monday's blackout.

Redeia announced its quarterly results to the market last Wednesday. The company reported a net profit of 137.8 million euros until March, representing a 4.2% increase compared to the same period of the previous year.