The aerospace industry is being shaken up by new companies threatening traditional leaders. With Boeing flirting with collapse - or a US bailout, which will not allow a key company for national defense to sink - SpaceX dominating space flights, and Blue Origin, owned by Jeff Bezos, trying to enter the market, a new player emerged this week: Boom, a startup aiming to introduce its supersonic passenger plane XB-1 to the market in four years. The XB-1, which broke the sound barrier for the first time on Tuesday, resembles the Concorde, a Franco-British project that flew for nearly three decades but was never commercially viable. Although many believe the XB-1 may not be seriously manufactured, its supporters argue that Boom has an ace up its sleeve: Donald Trump's interest in spectacular (or, for his critics, extravagant) projects that look good on screen.

The European defense industry not only lags behind the US but also Asia

In ten days, the NATO summit in The Hague will begin, where an increase in defense spending to 3.5% of GDP by 2032 will be announced. However, despite the proclamations, European rearmament seems to be inspired by the phrase of one of the architects of the Spanish Transition, Pío Cabanillas: "It is urgent to wait." In that context, it worked; in this one, it is not so clear. Japan is considering withdrawing from the GCAP project to develop a sophisticated fighter-bomber with the UK and Italy due to what it considers "lack of interest" from its partners. Indonesia is studying purchasing Chinese J-10 fighters instead of expanding its fleet of French Rafales. South Korea already has a powerful defense industry, supplying tanks to Poland and preparing to introduce a radar-invisible aircraft into service, something that Europe will not have until at least 2035.

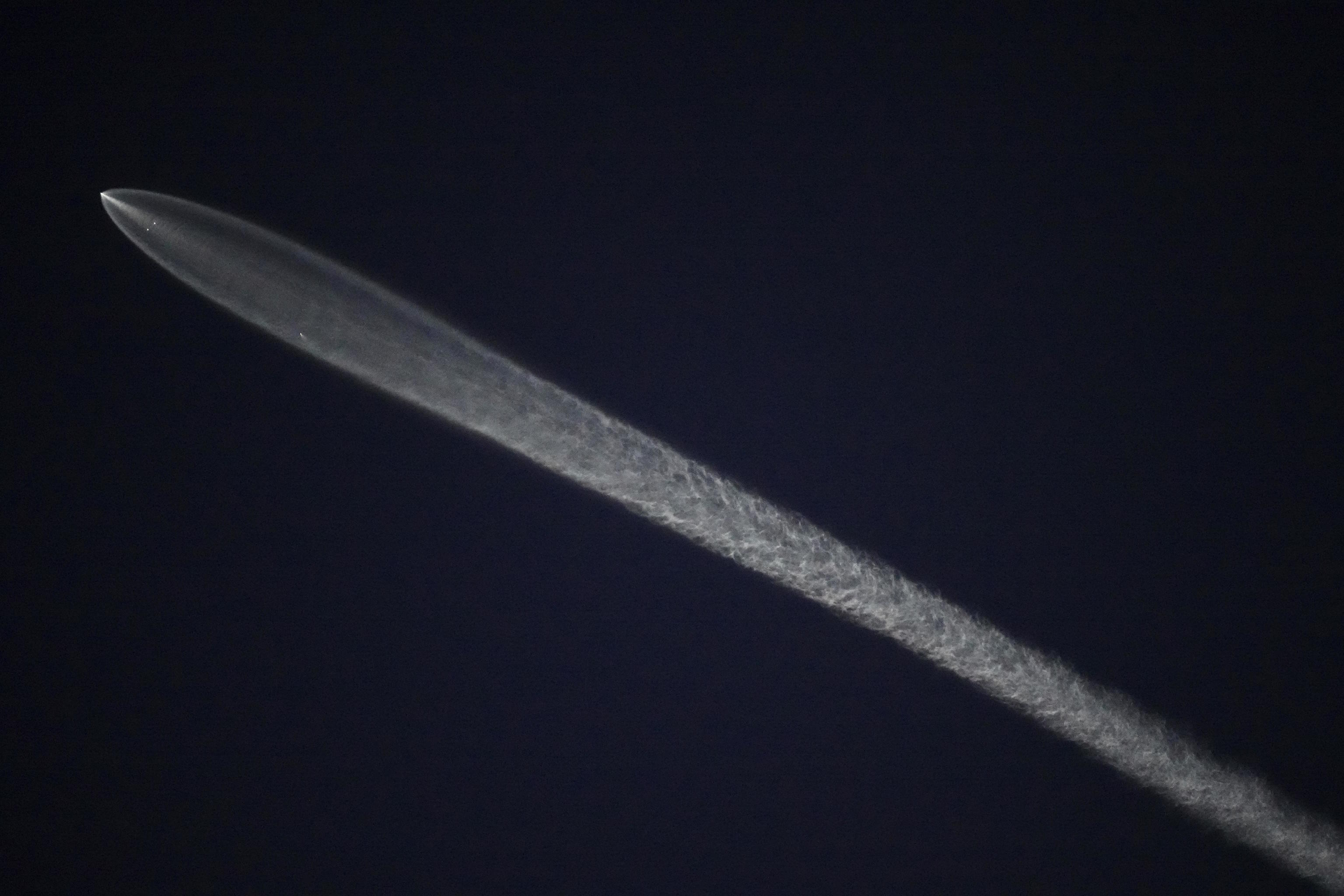

If Elon Musk gets stubborn, space belongs to China

The divorce between Donald Trump and Elon Musk has ended, for now, in an unstable truce, given the personalities of the two contenders. Although there is unanimous consensus that in the quarrel between the world's richest man and the US president, the former was at a disadvantage (Chinese and Russian experience reveals that in a fight between an autocrat and an oligarch, the autocrat always prevails), the fight could have been terrible for both and for the US. For example, without one of Musk's companies, SpaceX, the US is relegated to a distant second place after China in the space race, which would also imply total dependence on the International Space Station (ISS) for supplies. Furthermore, without SpaceX, there is no Starlink communication network, and without Starlink, a significant portion of the US Armed Forces would suffer a tremendous cut in their communication capabilities.

Greenland is worth 2.5 trillion and also wants to do business with Europe

The next time you buy a beauty product from Estée Lauder, think that Trump wants to do that - buy - but with Greenland, thanks to Ron Lauder, the son of the cosmetics giant's founder, who planted the idea in his head in 2017. According to the Association of Auctioneers of the United States, Greenland is worth around 175 billion euros for its natural resources, but 2.5 trillion for its strategic position. To the dismay of Lauder and Trump (whose fortunes combined are around 10 billion), the island wants to leverage its wealth with the help of the EU, not the US. Greenland's Foreign Minister, Vivian Motzfeldt, has stated that the island wants to develop the exploitation of its minerals "bilaterally" with the EU and has already granted a 30-year license to a Franco-Danish consortium for the exploitation of anorthosite, a mineral that could be a sustainable alternative to aluminum in the future.

Who benefits from the trade war? The pockets of US politicians

Donald Trump's trade war has, for now, had a great beneficiary: members of the US Congress. In April, the month when the US president launched his tariff "dance," the number of stock market transactions by representatives and senators doubled, according to a study published by the Wall Street Journal. The same had happened in January when speculation about the new president's policies led legislators to enter and exit the stock market like crazy, likely using insider information. A beautiful detail in this polarized era: all - Democrats and Republicans, "Trumpists" and moderates - participated with equal enthusiasm in the tariff stock market bacchanal. Given that the "truce" of the tariff war ends on July 8 and the US has only reached an agreement with the UK, next month could be another investor festival for congressmen.

Major shipping companies miss the Chinese presence in the Panama Canal

The sale - forced by pressures from the Donald Trump administration - of the management of two ports in the Panama Canal by the Chinese company CK Hutchinson to the US fund BlackRock may have appeased Trump, who was obsessed with that company divesting those assets managed since 1997. However, it has worried the world's shipping companies. The reason is that BlackRock's minority partner is the port management specialist TIL, owned by the Franco-Swiss company MSC, the world's largest shipping line, which controls Renfe Mercancías in Spain. This is precisely the fear of other major shipping companies like Maersk, CCG CCM, COSCO, etc.: that TIL will prioritize its parent company over them on a waterway famous for its traffic jams. The major maritime transport companies seem to trust the Chinese from CK Hutchinson more than the French and Swiss from TIL.