Cryptocurrencies, amidst criticism and skepticism, continue to rise in the market. "It's a bubble," "it's a youth trend," "they are useless"... all kinds of comments have been heard about this innovative technology. The truth is that amid all these comments, digital assets continue to appreciate and reach staggering figures. This is evidenced by a number that speaks for itself: the crypto market reached a $4 trillion market capitalization this Monday, according to CoinMarketCap.

This figure, more symbolic than technical, indicates the strength of the crypto market, fueled by the multi-billion-dollar inflows of institutional money from Bitcoin (BTC) and Ethereum (ETH) ETFs. ETFs are exchange-traded funds that are traded on the stock exchange like a stock. These funds of the two largest cryptocurrencies in the world were approved by the SEC (Securities and Exchange Commission) of the US and began trading in January and July of last year, respectively.

These two coins account for 72.3% of the total market capitalization of the crypto market and drive the prices of other assets, known as altcoins. Generally, Bitcoin, the mother currency that holds a 58% share of the total capitalization, sets the pace for other cryptocurrencies, including Ethereum. However, in recent weeks, it has been Ethereum that has driven the prices of the top 20 coins in the last seven days with a crypto-style surge: a very steep upward trend with a 16.5% increase.

In April of this year, cryptocurrencies were falling due to declines in global stock markets following Trump's tariff announcement. Ethereum was trading around $1,300, and just over 120 days later, it is trading at approximately $4,700, a 240% increase, and is about $200 away from its all-time high reached four years ago in November 2021. The rise of this crypto has been rapid thanks to the influx of significant institutional money. Major tech companies like SharpLink Gaming and BitMine Immersion Technologies, both listed on the Nasdaq, are heavily investing in ETH and accumulating more and more money in this asset as an investment and treasury. In fact, Ethereum surpassed large companies like Netflix and MasterCard in market capitalization this week and is now the twenty-second largest asset in the world.

However, it is the entry of large institutional capital into the Ethereum ETF that is driving the price surge. Last Monday, a record amount of $1.020 billion in total net inflows was added to this currency's exchange-traded fund, the largest amount since the SEC approved this ETF. This momentum was led by BlackRock, which saw a record inflow of $640 million into its "ETHA" fund, equivalent to over 150,000 ETH. This fund, listed on the New York Stock Exchange, rose by 6.2% on the last day and is trading at $32.35.

This Tuesday, the inflow of institutional money slowed down, but still with a significant capital inflow of $524 million, where BlackRock and Fidelity once again led with 60% and 21% of the total inflow. This amount remains very high, surpassing the Bitcoin ETF, which only saw $65 million in inflows this Tuesday.

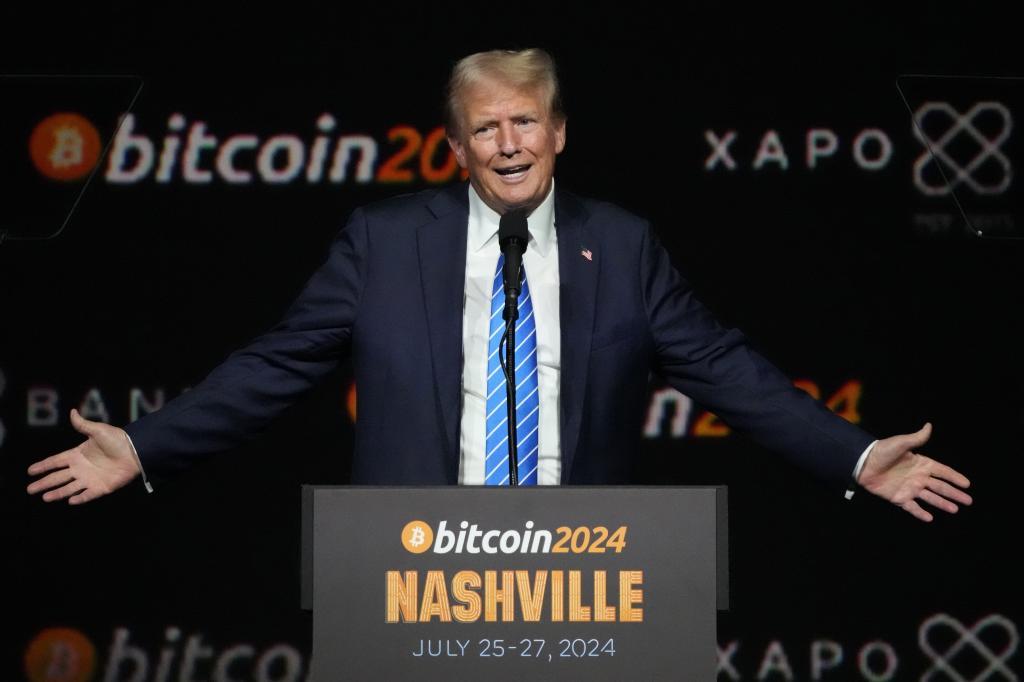

In this regard, Donald Trump signed an executive order allowing US private pension plans to invest in a wide range of alternative assets, including cryptocurrencies. This order will be reassessed by the Department of Labor, the SEC, and the Treasury Department to accept these private pension plans, whose capital would further open the door to more institutional capital entering cryptocurrencies, as the US holds around 63% of global pension funds, with trillions of dollars in assets.

Furthermore, on a macro level, cryptocurrencies are closely tied to stock markets, especially the US market, which is at all-time highs. Current expectations of a US interest rate cut in September, along with the delay in Trump's announced tariffs on China, have pushed stock markets to remain in the green.